What Is A Compensating Factor . Learn what lenders consider a compensating factor and how it can help you get an fha loan. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Are you wondering, “what are compensating factors?” don’t worry. An fha compensating factor helps borrowers qualify for an fha loan. Compensating factors are strengths in your financial profile that can be used to offset. To help you better understand your options, we’re going to review. A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Learn about compensating factors for fha loans.

from gustancho.com

Are you wondering, “what are compensating factors?” don’t worry. A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Compensating factors are strengths in your financial profile that can be used to offset. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. To help you better understand your options, we’re going to review. An fha compensating factor helps borrowers qualify for an fha loan. Learn about compensating factors for fha loans. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. Learn what lenders consider a compensating factor and how it can help you get an fha loan.

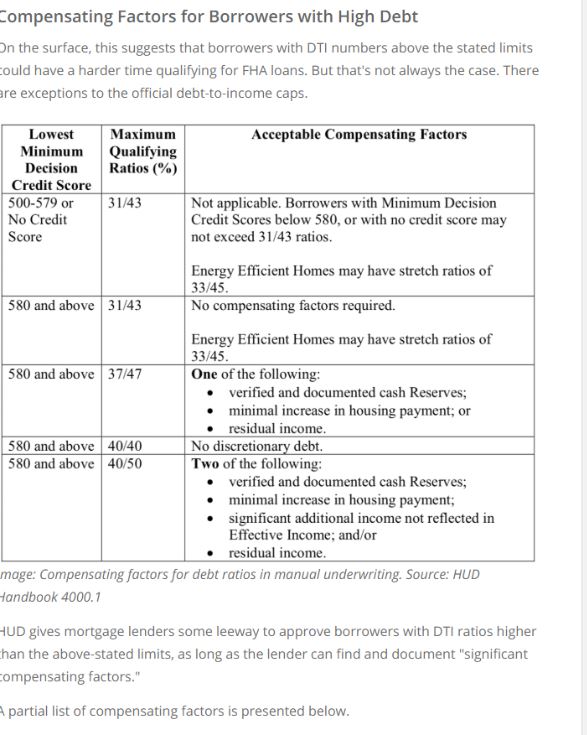

HUD Manual Underwriting DTI Guidelines

What Is A Compensating Factor Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. To help you better understand your options, we’re going to review. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Learn what lenders consider a compensating factor and how it can help you get an fha loan. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Learn about compensating factors for fha loans. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Compensating factors are strengths in your financial profile that can be used to offset. An fha compensating factor helps borrowers qualify for an fha loan. Are you wondering, “what are compensating factors?” don’t worry.

From www.studocu.com

Compensating variation and Equivalent variation Compenating variation What Is A Compensating Factor An fha compensating factor helps borrowers qualify for an fha loan. Learn what lenders consider a compensating factor and how it can help you get an fha loan. Learn about compensating factors for fha loans. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. Compensating factors are strengths in. What Is A Compensating Factor.

From www.ilectureonline.com

What Is A Compensating Factor Learn about compensating factors for fha loans. Compensating factors are strengths in your financial profile that can be used to offset. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Are you wondering, “what are compensating factors?” don’t worry. To help you better understand your options, we’re going to review. Compensating factors. What Is A Compensating Factor.

From www.electricaldesks.com

What is Series and Shunt Compensation? Its Advantages, Disadvantages What Is A Compensating Factor A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. To help you. What Is A Compensating Factor.

From tloponline.com

Compensating Factors TLOP Online What Is A Compensating Factor When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. An fha compensating factor helps borrowers qualify for an fha loan. A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Learn about compensating factors for fha loans. Compensating factors used to justify. What Is A Compensating Factor.

From www.superfastcpa.com

What is a Compensating Balance? What Is A Compensating Factor Compensating factors are strengths in your financial profile that can be used to offset. To help you better understand your options, we’re going to review. Are you wondering, “what are compensating factors?” don’t worry. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. An fha compensating factor helps borrowers qualify for an. What Is A Compensating Factor.

From gustancho.com

HUD Manual Underwriting DTI Guidelines What Is A Compensating Factor An fha compensating factor helps borrowers qualify for an fha loan. Compensating factors are strengths in your financial profile that can be used to offset. Are you wondering, “what are compensating factors?” don’t worry. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. When you need a mortgage, but you’re not a. What Is A Compensating Factor.

From www.pinterest.com

Internal external factors ed achievement SCLY2 Education Pinterest What Is A Compensating Factor Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Are you wondering, “what are compensating factors?” don’t worry. To help you better understand your options, we’re going to review. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. A compensating factor is something that. What Is A Compensating Factor.

From shawnimalee.blogspot.com

Fha multifamily loan calculator ShawniMalee What Is A Compensating Factor Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Are you wondering, “what are compensating factors?” don’t worry. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify. What Is A Compensating Factor.

From www.bluefiremortgage.com

Compensating Factors (1) Bluefire Mortgage What Is A Compensating Factor To help you better understand your options, we’re going to review. Compensating factors are strengths in your financial profile that can be used to offset. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. When you need a mortgage, but you’re not a perfect risk, your underwriters can build. What Is A Compensating Factor.

From www.pinterest.com

Conforming Loans 620+ FICO Max 45 DTI most lenders compensating What Is A Compensating Factor A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. To help you better understand your options, we’re going to review. An fha compensating factor helps borrowers qualify for an fha loan. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Compensating. What Is A Compensating Factor.

From gcamortgage.com

What Are Compensating Factors For Manual Underwriting What Is A Compensating Factor Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the. Compensating factors are strengths in your financial profile that can be used to offset. To help you better understand your options, we’re going to review. An fha compensating factor helps borrowers qualify for an fha loan. Learn about compensating factors. What Is A Compensating Factor.

From gustancho.com

Compensating Factors Considered By Lenders On Manual Underwriting What Is A Compensating Factor A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. To help you better understand your options, we’re going to review. An fha compensating factor helps borrowers qualify for an fha loan. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Learn. What Is A Compensating Factor.

From www.slideserve.com

PPT FHA TRAINING PowerPoint Presentation, free download ID3071796 What Is A Compensating Factor Are you wondering, “what are compensating factors?” don’t worry. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Compensating factors are strengths in your financial profile that can be used to offset. Compensating factors used to justify approval of mortgage loans with ratios that exceed benchmark guidelines must be recorded on the.. What Is A Compensating Factor.

From www.slideserve.com

PPT M anual Underwriting ML 201402 Effective Case Numbers Issued 4 What Is A Compensating Factor Compensating factors are strengths in your financial profile that can be used to offset. An fha compensating factor helps borrowers qualify for an fha loan. To help you better understand your options, we’re going to review. Learn what lenders consider a compensating factor and how it can help you get an fha loan. Learn about compensating factors for fha loans.. What Is A Compensating Factor.

From gcamortgage.com

What Are Compensating Factors For Manual Underwriting What Is A Compensating Factor To help you better understand your options, we’re going to review. Compensating factors are strengths in your financial profile that can be used to offset. When you need a mortgage, but you’re not a perfect risk, your underwriters can build a case. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Learn. What Is A Compensating Factor.

From slideplayer.com

CIS 487/587 Bruce R. Maxim UMDearborn ppt download What Is A Compensating Factor Learn about compensating factors for fha loans. Compensating factors are strengths in your financial profile that can be used to offset. To help you better understand your options, we’re going to review. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. An fha compensating factor helps borrowers qualify for an fha loan.. What Is A Compensating Factor.

From nationwidemortgageandrealty.net

Compensating Factors FHA & Compensating Factors for VA Loans What Is A Compensating Factor Compensating factors are strengths in your financial profile that can be used to offset. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. A compensating factor is something that is used as a positive to offset a negative in the borrower’s credit qualifications. Are you wondering, “what are compensating factors?” don’t worry.. What Is A Compensating Factor.

From www.mortgagelendersforbadcredit.com

FHA DTI Manual Underwriting Guidelines On FHA Loans mortgage Lenders What Is A Compensating Factor Learn about compensating factors for fha loans. Compensating factors are strengths in your financial profile that can be used to offset. Fha compensating factors are positive qualities that lenders can use to help borrowers qualify for a mortgage. Are you wondering, “what are compensating factors?” don’t worry. A compensating factor is something that is used as a positive to offset. What Is A Compensating Factor.